If your company wants to make a large investment, such as buying new aircraft, you can acquire a loan from the bank to make this happen sooner. Also, when you start your airline part of your initial funding may be a loan (depending on game settings).

The loan market in AirwaySim has variable interest rates and other advanced features such as loan margins, credit ratings and security assets. Airlines can only loan money from the bank. They cannot loan it from other airlines or otherwise transfer cash to other airlines.

Taking Out A Loan

Getting a new loan is simple and it involves two steps:

- Select the desired amount, repayment time and possible security assets.

- Review the loan quote and accept the terms.

The whole process is instantaneous and the sum is available in your account immediately upon accepting the loan terms.

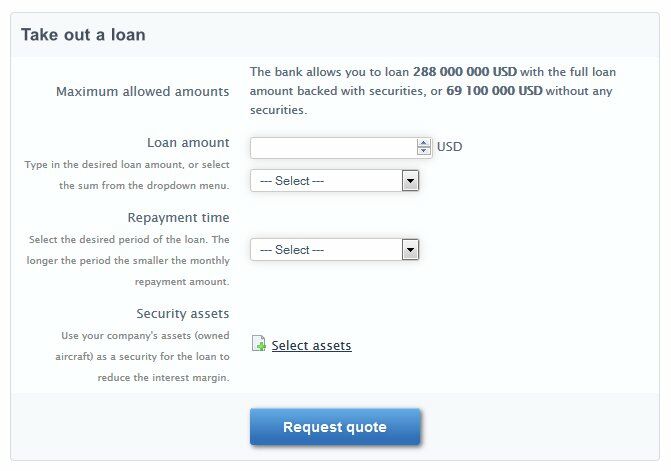

To take out a new loan, select or type the desired amount and select the repayment time. The maximum amount allowed for a new loan are displayed on the right side of the menu. These are based on the status of your company (such as credit rating and any other existing loans). Also, choose security assets (if applicable) and a new selection window opens for them - more about these later in this manual chapter. Then press Request quote.

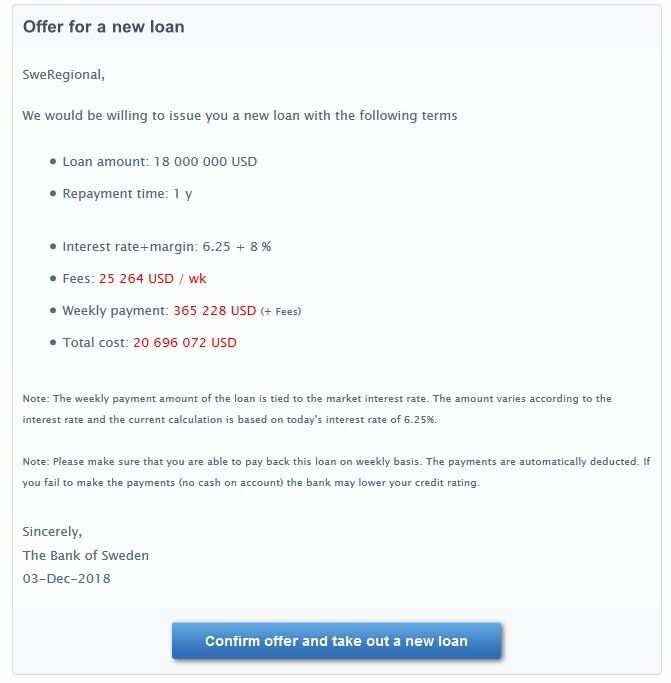

After these above steps, the loan terms will be presented to you. This includes first a summary of the options you chose and then the actual terms of the loan itself. These are:

- The current interest rate.

- Interest rate margin for your airline. This is the extra margin the bank adds on top of the global interest rate as "their cut" of the deal. The better the credit rating of your airline, the lower their margin is.

- Weekly transaction fees billed by the bank.

- Total weekly payment (of loan balance + interests).

- And finally, the total cost of the whole loan during the whole loan period.

Note! The quoted payment is only valid for today's interest rates. Interest rate changes means the weekly payments will also change accordingly.

If you are happy with the loan quote, confirm the offer and the money will be added to your account. The loan will be automatically paid back over the agreed repayment time. You can pay it back earlier too if you wish (described later in this manual chapter).

Loan Security Assets

There are two types of loans:

- Unsecured loan

- Secured loan

The first one is a high-risk option for the bank since your airline does not provide any securities or "guarantees" for the loan and, if your airline fails to pay it back, the bank does not have any assets to recover from your airline. This is also why the unsecured loan limit is always much lower than the other option which is the secured loan.

The secured option will provide some of your assets as security for the loan. If you fail with loan payments, the bank can then seize this asset from you in order to cover the missed payment. Only aircraft that you own can be used as loan security assets; leased planes are not available as they are not owned by you. Planes you own but you have leased out to other airlines are available as security assets like any other owned aircraft. Any aircraft used as loan security cannot be listed for sale since they must be in your ownership for the entire duration of the loan - however you can list them in the used market for lease only.

To use assets as security of a new loan simply use the Select assets menu and choose the desired aircraft (one or more) before requesting the loan quote.

Please note that if you wish to loan a higher amount than what the unsecured loan limit is, the corresponding difference must be fully backed by security assets. For example, if your unsecured loan limit is $10 million and secured loan limit is $100 million and you wish to loan this whole $100 million, then you must find security assets that are valued at least $90 million or more by the bank. Please also note that the aircraft valuation used by the bank is completely different from your book value of that plane or any possible used aircraft market price for that particular plane/model. The bank does their own internal valuation calulation for loaning purposes.

Once the loan has been taken out with securities, it must be paid back fully before the security assets are released again (for sale or for use in other loans for example).

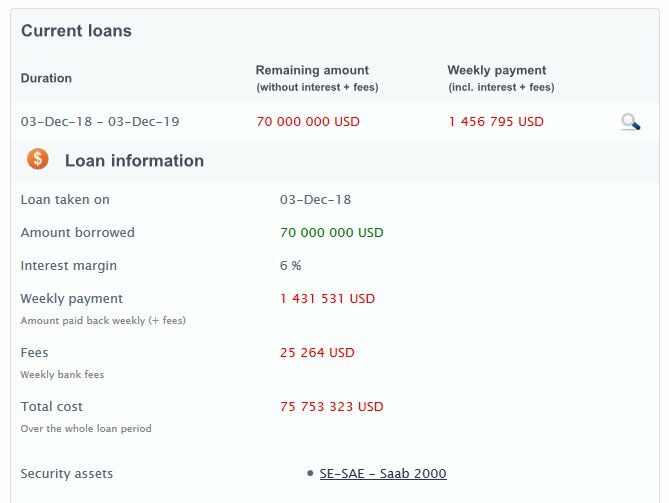

Aircraft that are used as security assets are listed clearly in the details of each loan, and same information is visible also in aircraft details page.

Paying Back A Loan

Loans are paid back automatically over the chosen length of time. However, you can choose to pay back the loan early. To do this, first click on the magnifying glass icon next to the loan to view the details.

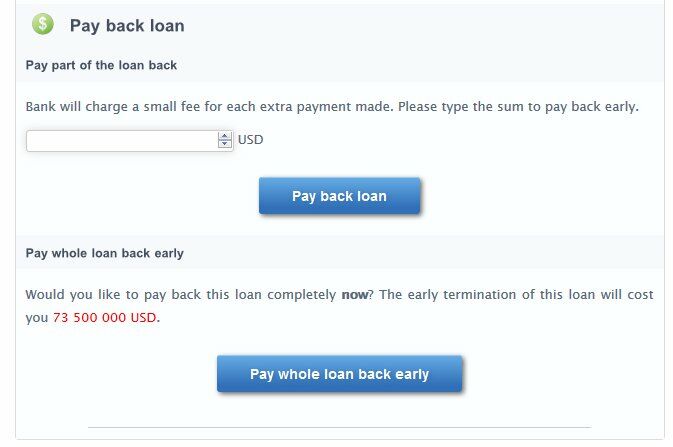

This expands the loan information menu with full details of that loan. You have two options at the bottom of the window - either pay it back completely or pay back part of it.

Paying back a loan early will always have a small penalty in terms of bank fees (you are getting out from a contract with a bank and they demand a small compensation of early loan termination).

Paying back a loan early will always have a small penalty in terms of bank fees (you are getting out from a contract with a bank and they demand a small compensation of early loan termination).

To pay back a part of the loan simply type in the desired sum. The total cost will be displayed to you below the text field. Or if you wish to pay it back completely, simply click on the corresponding button on the right.

Credit Rating

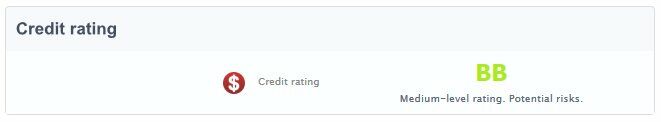

All airlines have individual Credit Ratings determined by the bank (automatically). The rating tells you and the bank about the financial condition of your airline and more specifically about the amount the bank is willing to loan to you.

There are 10 levels in the Credit Rating scale. Best is AAA and worst is D. The higher the rating, the lower risk the bank sees in your company. In other words, a higher credit rating menas cheaper loan terms for your firm. If the credit rating is too bad the bank will refuse to loan money. For example, a D rating would mean imminent threat of bankruptcy and no financial corporation wants to get involved.

Things that affect the credit rating are for example:

- Value of your airline

- Age of your corporation (more established the better)

- Company image

The terms of each loan depend on credit rating, other existing loans and the financial status of your airline.

Interest Rates

The interest rate is variable in AirwaySim game worlds. Normally the rate follows the historical real-world data but it can be also customized for each game world.

Usually the global interest rate is between 4-14%. Interest rate changes weekly. The current rates are displayed at the bottom of the 'Loans' page together with a historical data of the interest rate development.

There are two types of rates shown. The first is the interest rate paid for loans, and the second is the rate banks pay for your cash (which is stored in the banks). The credit interest rate is usually 5-7% lower than the loan interest rate.

Both of these rates are the same for all airlines as these are global interest rates. The differences in loan prices for each airline comes from the loan interest margins as explained previously.