This section describes how the accounting system works and explains how to read the presented information.

General

Modern corporations largely use an accrual based accounting system that is designed to match expenses with revenues. Smaller corporations and individuals may use a cash based system that records revenue and expenses in the period in which the money was received (or paid) regardless of when the service was provided.

The key is understanding that income or expense will be recognized in the period in which the service is performed or the expense is used. For example, a ticket purchased today and flown today is recognized as income in this year’s financial statements. A ticket purchased today and flown next year would be recognized in next year’s financial statements. Similarly, for an expense such an aircraft insurance premium that is paid today to cover the risk of accident next year would be recognized as an expense next year.

The goal of financial information is not to make players become accounting experts, but rather to better inform the player about the state of their airline. As a result, the simulation's accounting system follows basic accounting principles but has been simplified in some areas for better usability and to reduce complexity. However, basic principles such as cost allocation, depreciation and asset valuation still apply here just as in any other proper accounting system.

To understand the components of the accounting system, the following section goes through each of the basic principles of accounting in the simulation. It is important to remember that all financial transactions involve one of four items (revenue, expense, asset, or liability).

Revenue - Revenue is generated from four sources: ticket revenue, interest income, leasing income, and aircraft sales. All ticket and interest revenue is received on a daily and/or weekly basis as there are no advance ticket purchases in the simulation. You may also at times lease out one of your aircraft to another airline. In exchange for the lease agreement, the other airline will pay you 4 months of leasing income in advance. This amount is recorded on the balance sheet as unearned income (this will be discussed in more detail later). Aircraft sales are considered revenue to your airline but you only pay tax on the difference between the sale price and the value of the plane (this is also discussed in more detail below).

Expenses - Expenses are generated as a result of running your airline. You have salaries to pay, maintenance to perform, and fuel to burn. There are two types of expenses: cash expenses and non-cash expenses. Salaries, maintenance, and fuel are all cash expenses in the current period, except for D-checks (discussed in detail below). Non-cash expenses such as depreciation reduce the value of assets to account for the usage of that asset.

Assets - Assets are your economic resources such as cash (liquid assets) or aircraft (tangible assets). The value of the airport slots are also counted as assets (intangible assets) as well as deposits on aircraft to be received in the future. Simply said, assets are something that your company owns. Note that you may sell aircraft to other airlines, but slots are untradeable and if unused will be returned to the General Authority of the Airport.

Liabilities - The reverse of assets - your financial obligations to someone (loans for example).

Using these four concepts, you can get a good understanding of the success (or failure) of your airline.

Financial Statements

To help players understand their financial position, the simulation produces three financial statements:

- Income Statement, which records the revenues and expenses of a Company in a given period. The difference between a company’s revenue and expense in a given period is a Company’s Net Income (or Profit). This is the amount that is taxed by the authorities.

- Fun fact: Profit and Income both refer to the money earned by the Company after all expenses are paid. These terms are used interchangeably.

- Cash Flow Statement, which takes the net income reported by the Income Statement and adjusts it for non-cash items such as depreciation. The net amount of cash flow represents the actual cash available for use by a company in a given period.

- Balance Sheet, which records a Company’s financial position at any point in time including both assets and liabilities. The difference between assets and liabilities is the company’s value, which goes up over time should an airline be successful. Please note that the Income Statement reflects the changes in a Balance Sheet from one period to the next. For example, the income statement for the year 2004 reflects the changes from the Balance Sheet as of year-end 2003 to year-end 2004.

Revenues In Detail

A company has the following sources of revenue in the simulation:

Operating Revenue:

- Ticket sales (economy, business and first class)

- Cargo sales (light, medium and heavy)

Non-Operating Revenue:

- Gains on sale of aircraft (defined as the difference between sales price and book value – accumulated depreciation)

- Ongoing aircraft leasing revenue (leasing income received subsequent to the initial four months of leasing income)

- Prepaid aircraft leasing revenue (defined as the four months of income paid to you at the inception of a lease for one of your aircraft)

- Aircraft leasing termination fees (income as a result of an airline terminating a lease of one of your company’s aircraft)

- Interest income (income resulting from the cash balance of your airline)

Ticket revenue occurs as a result of airline operations and is considered a normal part of revenue from operations. The other five sources of revenue are not revenue from core operations. This classification affects how they are displayed on the income statement and the cash flow statement. Revenue from operations is considered in Operating Profit/Loss on the Income Statement and in Cash Flow from Operating Activities on the Cash Flow Statement. The other revenue sources are considered as part of other income and/or cash flows.

Note that all revenue is counted as income on the day in which it is received, except for prepaid aircraft leasing revenue. This revenue occurs when another airline agrees to lease an aircraft from you. In exchange for leasing the aircraft, the airline pays you four months’ leasing fees in advance. These fees bring you immediate cash and are recognized as unearned income on the balance sheet. As the other airline flies your plane, this unearned income will be recognized as income. After the four months are up, any additional leasing income (i.e. ongoing aircraft leasing revenue) is recorded as income as it is received.

Expenses In Detail

A company has several different sources of expenses which are divided into two main categories; operating expenses and other expenses. This classification of expenses is consistent with the classification of revenues described in the prior section.

Operating Expenses - these expenses are incurred on a weekly or daily basis and they are necessary to operate your aircraft. All operating costs are taxable expenses.

Fixed costs: These are weekly costs that are paid regardless whether your aircraft are flying or not. These expenses can increase or decrease depending on what plane types your airline flies, costs associated with properly maintaining, leasing (if applicable), insuring and staffing these aircraft.

- Staff salaries: Salaries reflect the earnings of your airline’s employees and are paid on a weekly basis. Salaries are determined by the pilot and crew requirements of each plane as well as the support staff required depending on the number of routes.

- Staff training: Training reflects the ongoing training needed to keep your staff current on systems and regulations necessary to keep your airline flying. Training costs are depending on the number of aircraft and engine types based on the simulation’s fleet commonality system. The more types of aircraft and engines that you have, the higher your training costs will be. Training costs are deducted daily.

- Fuel contract fees: Your airline may enter into a fuel contract that offers a percentage discount on fuel in exchange for a guaranteed fixed fee. This fee is deducted on a daily basis and is considered an operating expense.

- Aircraft insurance: All of your aircraft must be insured against loss, although the required coverage is lower for owned aircraft. Owning a higher percentage of your fleet will lower your insurance costs. Insurance costs are deducted daily.

- Aircraft leases: For those aircraft that you do not own, you have to pay a leasing fee to the company that owns the aircraft. This amount is deducted on a daily basis.

- Aircraft parking: If you have aircraft that do not currently have routes assigned, you pay a parking fee to store the aircraft until it is needed. This fee is assessed when you have more than 10 active aircraft that do not have routes (either on the Used Market or just pending route assignment) as well as to all planes currently in storage. The storage fee is deducted daily.

- Aircraft maintenance: All aircraft require maintenance in order to remain in good working order. Maintenance associated with commonality charges is assessed daily, whereas aircraft specific maintenance checks (A, B, and C checks) are assessed as incurred. D checks are not considered an expense, but rather capitalized and depreciated over the remaining life of the aircraft; however, you will pay cash for the D check when required as part of aircraft maintenance (typically every 8 years). Western and modern aircraft tend to have a lower maintenance expense relative to Russian and/or first generation aircraft.

- Depreciation: All aircraft are assigned a book value at acquisition based on the purchase price. This value is then depreciated in a straight-line fashion over the remaining useful life of the aircraft to age 25. The cost of D-checks are added to the book value of the aircraft and depreciated in a similar manner. This is a non-cash expense that serves to reduce an airline’s taxable income. More expensive aircraft will tend to have higher depreciation charges as they will have higher book values. Depreciation is deducted once every game week.

- Marketing: Your airline must advertise to fully attract customers. This expense is deducted on a daily basis for general marketing campaigns and on Monday’s for route specific marketing campaigns.

- Office rent: Your airline must pay rent on its airport facilities. The more airports you serve and the larger your airline is the more rent you will have to pay. This expense is deducted daily.

Variable Costs: These are costs that you pay each day based on the actual flight data from your fleet. If your planes don’t fly, these costs are not incurred. Aside from fuel, most of these charges are dependent on the size of the aircraft and how busy the airport you are flying to/from. Flying from the largest airports will incur the largest fees, but also offer the greatest rewards due to the large number of passengers demanding air transit from that city.

- Fuel: The fuel expense reflects the actual fuel burned by your airline at the current market price net of any fuel contract discounts. If you have hedged fuel then, instead of the current market price, you will be charged the hedged price.

- Passenger fees: This is the cost of processing passengers at each destination airport. It is charged for each passenger that departs from that airport by the local airport authority. The size of charge is based on the size of the departing airport and how busy that airport is.

- Navigation fees: Navigation fees are charged based on distance travelled and the MTOW of the aircraft. Flying longer distances with bigger planes will mean higher fees.

- Landing fees: This fee is charged to each plane landing at an airport based on its MTOW. Planes with larger MTOW pay a higher landing fee. Larger and/or busier airports have higher charges per each MTOW.

- Ground handling: This fee is paid for turnaround service on the ground. Smaller aircraft have lower charges. The overall price level for these services is also dependent on the size of the airport.

- Alliance fees: This fee is set by the alliance you are a member of. It ranges from 0% to 1% of ticket revenue and is charged at 12:00 on Mondays.

Fines: The third type of operating expense are fines. These are levied to aircraft that receive a ramp check and have expired maintenance. The fine tends to be fairly nominal but the ramp check also imposes a significant Company Image penalty that can take a long time to heal. They are imposed on the day of violation.

Non-Operating Expenses: In addition to the operating expenses described above, an airline can generate additional expenses through 4 expenses that are not core operating expenses.

- Aircraft lease fees: These fees are paid when an airline cancels an aircraft lease prior to its expiration. This line also includes the non-refundable portion of new aircraft lease's prepayment (5 month's leases prepaid, together with a sum equalling 1 month's lease as a non-refundable delivery fee.

- Loss on sold aircraft: If an airline sells an aircraft for less than the book value of an aircraft, the airline will record a loss equal to the difference between the book value and the sale price.

- Bank fees: If an airline takes a loan out from the Bank, it has to pay fees for the privilege of taking out the loan. Additionally, any loan processing fees (like in case of early loan prepayment) are included here.

- Interest: Any interest that an airline pays as a result of taking out a loan are included here.

Taxes: Once all of an airline’s revenues and expenses are tallied, an airline will owe tax to the government authorities based on the tax rate for that jurisdiction. For example, if an airline makes $100 million in profit, and it’s tax rate is 35%, then it will owe $35 million in taxes.

Non-Expense Outlays: In addition to the expenses noted above, an airline can incur a number of costs that can cause an airline to spend money, but are not considered an expense. Instead, these items convert cash (an asset) into another asset that is used over time. The expense is incurred when the asset is used, not when the asset is purchased. Note that because you are paying the cash immediately, but not recognizing an expense, non-expense outlays do not affect your taxable income.

- Prepaid aircraft: Any aircraft that you buy is included as a prepaid aircraft until it is delivered. Typically, for planes purchased from the Used Market, this may be a short period (2-4 weeks). For planes purchased from the manufacturer, this may be months or years depending on the production queue. For example, consider a $100 million aircraft that you just bought. You would pay $100 million in cash to the other airline and in exchange would have a credit in prepaid aircraft for the $100 million value of the plane. When the aircraft arrives, the $100 million would move from prepaid aircraft (an asset) to Flight Equipment (another asset). As you fly the aircraft, the simulation will then calculate a depreciation expense that reflects the wear and tear on the aircraft. This depreciation expense will reduce your taxable income.

- Prepaid leases: Similar to prepaid aircraft, if you lease an aircraft, you prepay 4 months of lease for used aircraft and 5 months for factory-new aircraft. As you fly the aircraft, you will use the prepaid lease amount, which is converted to a leasing expense (and will reduce your taxable income at that point).

- Maintenance D-Checks: Every eight years, an aircraft is required to undergo D-check maintenance. This takes the aircraft out of service for a lengthy period of time (60 days for a large plane) to perform extensive maintenance. Given that this check covers 8 years, under the revised system, the cost of the D-check will be added to the book value of the aircraft and then depreciated over the remaining life of the aircraft.

- Airport slot fees: Given the long-lasting value that slots give an airline (the right to take-off from that airport at that time slot indefinitely), slots are considered assets. Thus, buying slots will no longer reduce your taxable income until you close the route or the slot is taken away. Once you no longer control the slot, the original purchase price will be charged as an expense.

Assets In Detail

There a number of assets, besides the obvious owned aircraft and cash at hand, that the system tracks. Note that total assets are not the same as company value which includes any liabilities the company has incurred.

Current Assets: Current assets are those that are typically realised and/or convertible to cash within 1 year.

- Cash: Reflects the cash currently available for the company to spend.

- Prepaid Expenses: This includes lease payments that have been paid but not yet used. These include both aircraft leased from the used market and from the aircraft manufacturer.

Non-Current Assets: Non-current assets are those that are typically held over a period of time longer than 1 year.

- Flight Equipment: This value reflects the current book value of all the aircraft owned by your company net of depreciation.

- Deposits on Flight Equipment Purchases: This value reflects the amount paid to date to acquire future owned aircraft.

- Intangible Assets: Reflects the cumulative amount you have spent to date on slots, net of any slots you have relinquished control of.

The sum of these assets reflects the total assets controlled by the company.

Liabilities And Equity In Detail

Given that airlines in the simulation pay for most of an airline’s expenses on a daily basis in cash, there are a limited number of liabilities that an airline can incur. Note that the sum of liabilities and equity should be equal to a company’s assets. Said another way, assets minus liabilities is equal to the Shareholder’s Equity.

- Shareholder’s Equity (common stocks & retained earnings): The current value of your airline. This consists of the initial investment made and any subsequent profits/losses.

- Liabilities (loans): The current amount of loans the airline has outstanding.

- Liabilities (unearned income): This includes lease payments that have been paid to you by others, but not yet used. This occurs when you lease an aircraft to another player on the used aircraft market. They pay you for four months of lease fees in advance.

Financial Statements

To enhance the player’s ability to analyze the performance of his or her airline, the simulation prepares financial statements on a weekly, monthly, quarterly, and yearly basis.

Fun fact: The simulation’s accounting unit of measure is a week, so a monthly financial statement runs from the first Monday of the month through the week starting with the last Monday of the month. This means that some months have 5 weeks and others have 4 weeks depending on how many Monday’s are in that month. This is due to the structure of the data storage system.

There are three financial statements that are produced:

- Balance Sheet: describes an airline’s financial condition at a point in time by detailing an airline’s assets, liabilities, and shareholder’s equity.

- Income Statement: describes the income earned in a given period and is taxed on this income at the rate established by the jurisdiction of the airline’s HQ. The income or loss in a period will cause the Company’s shareholder’s equity to increase or decrease.

- Cash Flow Statement: describes the amount of cash generated by the airline in a given period. This amount differs from the income statement because certain items consume cash (aircraft purchases, slot purchases) but because these purchases generate an asset, they are not considered an expense (which would reduce income). Other items (depreciation) reduce income but do not change a company’s cash. The cash flow statement adjusts a company’s income to reveal how a company is earning and spending its cash.

The contents of each of these reports are discussed in more detail below.

Fun fact: The balance sheet shows the health of a business from the day it started operations to the specific date of the balance sheet report. The income statement and cash flow statements only reflect performance of a specific period (February 1985 for example).

Balance Sheet

The balance sheet is organised into three sections: assets, liabilities, and shareholder’s equity. A company’s assets minus its liabilities is equal to its shareholder’s equity ("company value").

Assets: For detailed discussion of the assets on a company’s balance sheet, refer to the Assets section above. A company’s total assets are equal to Cash + Prepaid Expenses + Flight Equipment + Deposits on Flight Equipment Purchases + Intangible Assets (slot fees).

Liabilities: For detailed discussion of the liabilities on a company’s balance sheet, refer to the Liabilities section above. A company’s total liabilities are equal to Loans + Unearned Income.

Stockholder’s Equity: This is the book value of a company and is calculated as assets minus liabilities.

Income Statement

The income statement shows a company’s results of operations. Using this statement, you can see if a business has income or loss during the financial period. All the company’s revenue, expenses, gains, and losses appear on this financial statement.

Revenues and expenses (individual line items are discussed in detail above) are separated based on whether or not the item is an operating revenue/expense or non-operating. Operating items include any revenue/expense that is directly related to the core flight operations of the airline (ticket revenue, fuel expense, maintenance, depreciation, etc.). Non-operating items include leasing income, interest income, gains or losses on sales of aircraft, etc.).

A company’s taxable income is the sum of operating and non-operating revenues and expenses. For example, if a company has $500 million in ticket revenue, $300 million in operating expenses, and $20 million in interest income, then the company’s taxable income would be $220 million. The tax rate depends on the jurisdiction the company’s HQ is based in, but typically ranges from 0% - 40%.

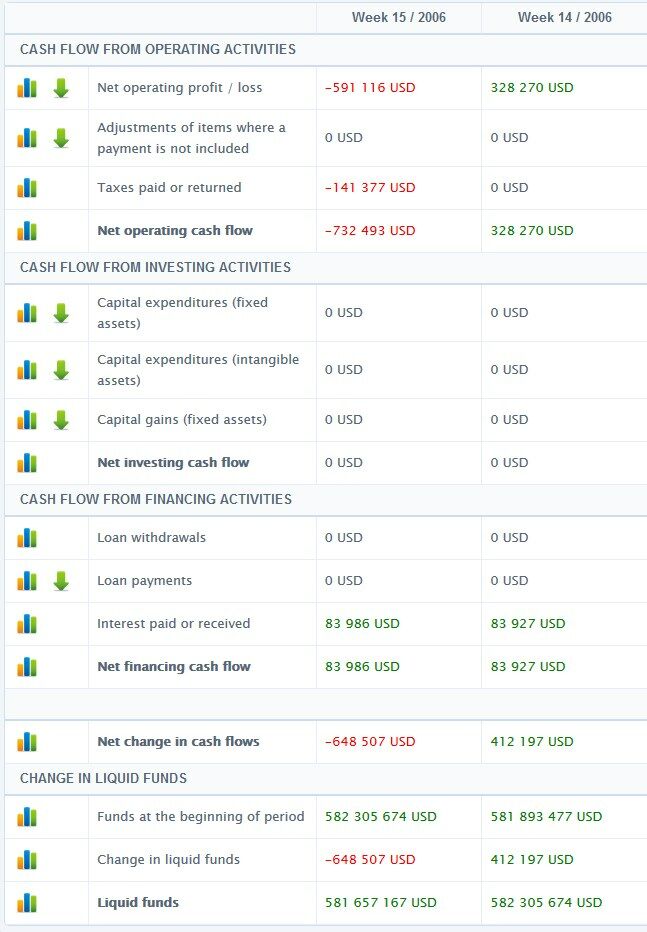

Cash Flow Statement

The cash flow statement reveals how a company brings in and spends cash. It tracks all events where cash changes hands. A company’s cash flow is different from its income because certain items that use cash are not considered expenses (aircraft purchases, slot purchases, etc.) and certain items that are expenses do not use cash (depreciation etc).

The Cash Flow Statement is divided into three sections:

- Cash flows from operating activities

- Cash flows from investing activities

- Cash flows from financing activities

Cash flows from operating activities: Any cash transactions that directly relate to an airline’s core business of transporting passengers and cargo around the world. It is the sum of the operating profit/loss from the income statement and then adjusted for any depreciation and tax payments. For example, if a company had $200 million in operating profits, had $30 million in depreciation and paid $10 million in tax, then the company’s cash flow from operating activities would be $220 million.

Cash flows from investing activities: Net investing cash flow is designed to show uses of cash related to transactions that impact the capital stock of an airline. It is calculated as the sum of capital expenditures (purchased aircraft and lease fees), capital expenditures (slot fees), and capital gains (gains or losses from aircraft sales and leasing income).

Cash flows from financing activities: Net financing cash flow is designed to show uses of cash related to transactions that impact the capital structure of an airline. It is calculated as the sum of loan withdrawals, loan payments, loan fees, and interest paid/received.

The sum of these three cash flow types reflects the net change in cash flows over the period.

Taxation

Taxes are paid based on a simplified "rolling" payments method based on your profits. The tax rate varies from country to country, and it is visible on the income statement and country information pages. (please note that if you have many base airports, in different countries, the tax rate will always be based on your HQ).

Tax advance is paid at the end of each week (Sunday 24.00) and the advance sum is calculated from the total result from that week (shown in income statement as "Profit / loss before taxes"). If your profit for that period is, for example, $1 000 000 and tax rate is 30%, you shall pay $300 000 of taxes. This payment is visible on the next line, called "Income taxes", and your total "Net profit / loss" will also be reduced by that amount, as well as your cash at hand. If you have made a loss (negative result), no tax advances are paid.

The tax system also takes into account any possible losses created during last 3 years and adjusts the tax advance payments accordingly.

At the end of each year a tax payment overview will be calculated by the system and sent to your game inbox. Also if you have paid too much taxes that year, they will be refunded at the same time. For example if you have made healthy profits in January (let's say $5million) and paid taxes for it (with the 30% rate that's $1.5million), but the rest of the year has not been profitable and you have made a total loss of $8 million during February-December then your total taxable result for that year is -$3million. In this case all of the paid taxes that year ($1.5mil) will be returned. (any paid taxes from the previous years won't be returned to compensate)